Press Items: Senator Paul Bettencourt — District 7

FOR IMMEDIATE RELEASE

October 17, 2022

(512) 463-0107

michael.geary@senate.texas.gov

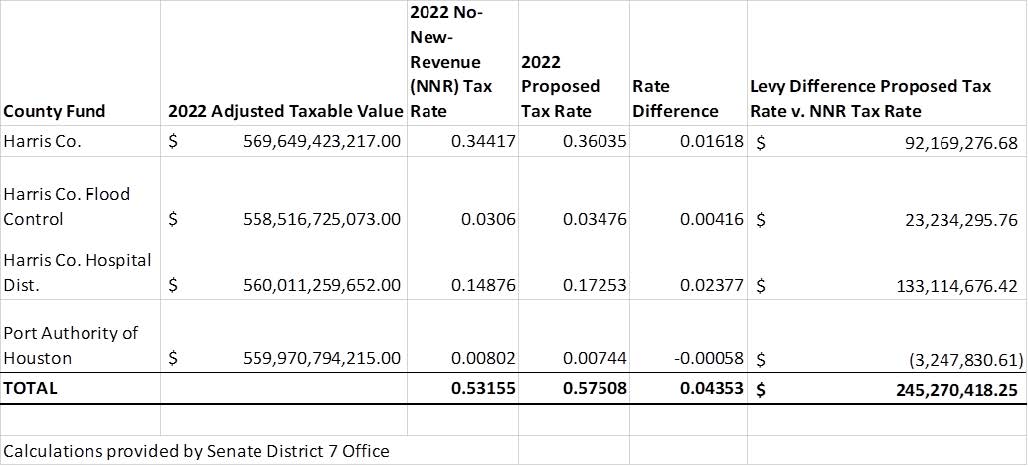

Houston, TX – Senator Paul Bettencourt (R-Houston) lauds Harris County Commissioners Jack Cagle and Tom Ramsey as they take a proactive stance using the No-New-Revenue Tax Rate (NNR) to deliver a quarter of a billion dollars of property tax relief. This county budget fight has important consequences for taxpayers because if the higher tax rate is adopted, 10.8% more property taxes will be levied on all Harris County taxpayers. Given the public's ever increasing focus on the economy and inflation, a double-digit tax increase would not be welcomed by taxpayers in Harris County, Brazos County, or anywhere else!

"Basically, by proactively standing up for taxpayers, Commissioners Cagle and Ramsey are keeping them from being walloped by a proposed 10.8% property tax levy increase," Senator Bettencourt said. "Commissioners Ford and Aldrich in Brazos County are also trying to prevent a double-digit increase from impacting their taxpayers. The "why" is simple! Taxpayers are very worried about their bottom line in 2022, as inflation drags down the economy."

"Spiraling property tax bills are the last thing taxpayers need," he said.

This would be historic property tax relief of $245 million for Harris County. The No-New-Revenue tax rate allows for the same tax levy from last year's tax roll plus new growth up $72 million. The best deal for taxpayers in these situations is the No-New-Revenue Tax Rate. See chart below.

"It takes the leadership of two Commissioners to take a proactive stance to get tax relief to taxpayers. Also, Harris County had $1.3 billion of unincumbered budget reserved along with $1.1 billion in the Hospital District as of the beginning of the fiscal year. This is the same issue in Brazos County as they have nearly $93 million for 11 months of operating reserves. You shouldn't plaster the taxpayers when you're sitting on huge governmental coffers!" concluded Senator Bettencourt.

Brazos County's property tax rate must be set by Friday, October 21, 2022 and Harris County's property tax rate must be set by Friday, October 28, 2022 or the No-New-Revenue rate under SB2 goes into effect.

###